Life is not predictable at all; uncertainty happens with many. Premature demise can occur to anyone leaving the family behind with financial and emotional turmoil. Here comes the crucial role of “Insurance” that compensates against unforeseen financial situations or life events.

Table of content

1. What is Insurance?

2. What is Life Insurance?

3. How beneficial is it to have Life Insurance?

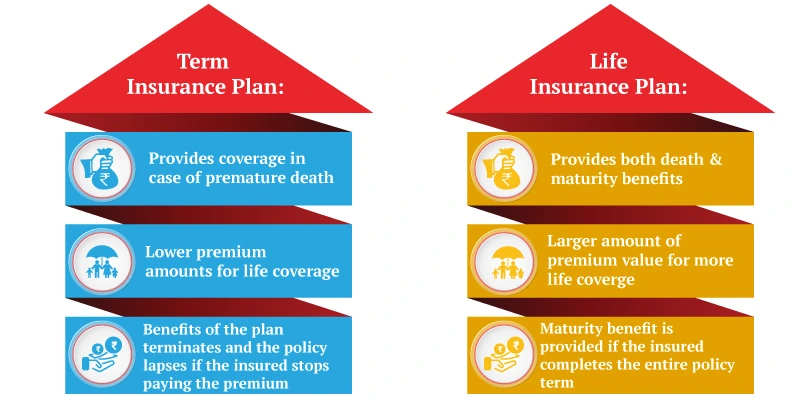

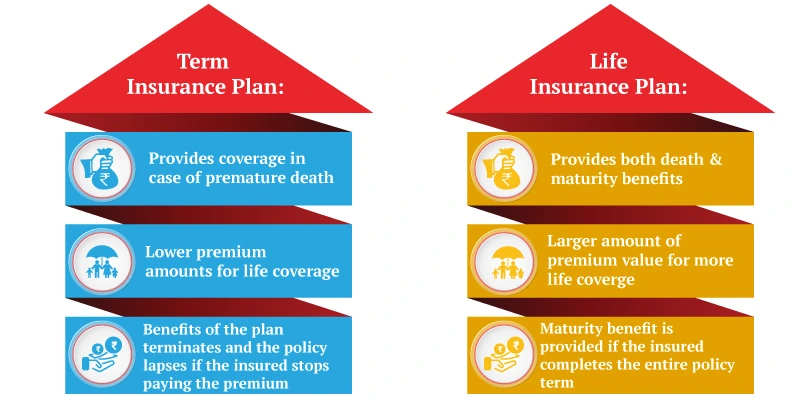

4. Understand Term Insurance Plan

5. Lucrative to have Term Insurance Plan

6. Comparison of life insurance and term insurance

7. A better option?

‘Insurance’ is a term that many of us are aware of, and most of us are familiar with insurance terms such as life insurance, car insurance, health insurance, house insurance, term plan, and many more.

Even businesses also need insurance policies to secure against any risks faced by business owners. Have you ever realized or thought about how it works?

What is Insurance?

In simple and easy words, when any individual or business opts for an insurance policy then indirectly, he transfers his risk of financial losses to the insurance company in exchange for the calculated insurance premiums.

The insurance company considers the risk of the person or business (property, business, life age, risks, etc.) and offers a calculated timely polity premium, the higher the risk of the event the higher amount as the premium will be decided by the company.

This blog is to outline the life insurance plan with its term insurance policy. The important factor to consider in life insurance policies is that it is beneficial to build a long-term financial entity for your future and takes your family to the safer side with instant financial support in case of any mishap happens to you as death occurs.

Life insurance plans comprise two policies- one is traditional life insurance policies and the other one is term insurance policies.

Scratching your head? Which one to consider protecting your risk- Life Insurance or Term Plan?

Let’s figure out-

What is Life Insurance?

As described above in simple words- it is designed as a contract between the insurance company or insurer and the insured customer in which an insurance company guarantees to cover the life of an insured customer and handles the savings and investments and gives you the returns additionally to the coverage of life, in return of the periodic amount called as “Premium”.

It offers substantial and comprehensive coverage to the policyholders and their families. The life insurance policy premium varies on the plan chosen by the customers.

IRDAI- The Insurance Regulatory & Development Authority of India regulates the insurance sector in India!

Let’s understand the primary difference in basic Life Insurance Plans-

| Types of Life Insurance Plans | Primary Features |

| Complete Life Insurance Plan | Covers the policyholder’s life and death benefits for the whole duration |

| Child Insurance plan | It comes to securing the future of a child’s financial requirements together with investment and insurance |

| Endowment Plan | It comes with 100% death maturity benefits |

| Pension Plan | It is helpful to give monthly income to a policyholder when gets retired |

| Money Back Plan | It gives back the maturity benefits either in round-sum or in installments |

How beneficial to have Life Insurance?

- Financial well-being- A life insurance policy brings sustainability to you at the time of financial crisis, it supports the families when any misfortune occurs especially, the sudden demise of a policyholder. Life insurance company grants to pay a beneficiary or nominee the pre-defined amount assured, resulting in a policyholder’s family remaining protected even after the policyholder.

- Savings in tax – Under the Income Tax Act of 1961, life insurance provides dual tax benefits. Under section 80c, its paid premium can be profitable as a tax deduction. You can get benefits of tax deduction up to Rs 1.5 lakh under the Income Tax Act of section 80c. Additionally, under Income Tax Act-section 10(10D), the insurance plans of maturity might get you a full tax-free.

Amazing Tax Savings!

- Savings for long-term– Indeed, a life insurance plan offers you to build financial assets. If someone is looking out to have investments for the long term, you might not need to think twice about life insurance. It is helpful to have lucrative savings and build wealth to convert into healthy prospects.

- Money-Saving- Undoubtedly, the life insurance plan comes up with strong financial security for the family of a policyholder. How much premium is to be paid by the policyholder depends on gender, health, life expectancy, as well as age. Life insurance gives you the chance to pay low premiums while you are young. Turning older with time will make your premiums higher to pay.

So, these are some relevant facts presented to have life insurance plans!

Let’s understand Term Insurance Plan:

It is a kind of life insurance policy that offers insurance coverage to cover against paid fixed-premiums for a term policy- it is one of the pure products of life insurance- term insurance.

It is suitable to give compensation to a nominee or family solely at the death of the insured customer. They are well-built to cover death benefits and no savings in the term plans.

It comes out with considerable importance to cover with minimal premium prices. For instance, an individual can get coverage up to 1 crore just by paying an amount of some thousand rupees.

But in a real sense, if anyone is really concerned about full financial protection of his family after him/her then Term insurance is most suitable to opt for.

However, if the policyholder survives healthily till the policy term, he won’t get any benefits but as said life is uncertain, if something goes wrong his dependent will get enough to manage their living expenses, and he can happily rest in peace😊

Listing out the Different types of Term Insurance Plans-

| Types of Term Insurance Plans | Primary Features |

| Increasing Term Insurance plan | Coverage increases with life stages |

| Decreasing Term Insurance plan | Coverage decreases as per the policy’s duration |

| Level Term Insurance plan | Same premiums all over the policy’s duration |

| Convertible Term Insurance plan | The policyholder can convert the existing plan to another insurance plan |

| Premium’s Return | A policyholder gets the full return of premiums paid if survives till the end of the policy |

How Lucrative to have Term Insurance Plan

- Low premiums- A term insurance plan gives you high-value life cover just by paying a reasonable amount of premiums. Payment can be done yearly, half-yearly, and monthly- no burden-it is like buying a term insurance plan early and paying less.

A great fact about it.

- Critical illness cover- If opted for critical illness cover, then you get a round sum amount on being diagnosed with any serious illness in this plan.

- Sum-insured pay-out- The family members are liable to get the assured sum as a pay-out provided if any mishap happens with the insured person. The policyholder has the choice to select the pay-out as a round sum, an income of either annually or monthly, and a combination of round sum and income, this helps with financial requirements in all ways.

Accidental death benefits can also be added to the term insurance plan to get protection against any uncertainty.

- Benefits of tax Under section 80c, get tax benefits on the paid premiums and the premiums paid for serious illness under 80D. Under section 10 (10D), Income Tax Act of 1961- the death benefit will get an exemption from taxes, and the nominee will get the round sum.

So these are certain facts about term insurance plans.

Let’s have a quick comparison between life insurance and term insurance-

| Specifications | Life Insurance | Term Insurance |

| Coverage Limit | Suitable for both death and maturity benefits | Suitable only for death coverage |

| Beneficial | Provides two benefits- protection and savings | Provides only death benefits |

| Premiums | Comes with high premiums | Comes with low premiums |

| Tenure | Optional for changing the policy’s tenure | Fixed tenure |

| Policy loan | Some plans do offer loan facility | No loan facility |

| Tax benefits | Nominees get death/maturity benefits in the tax-free form under section10(10D) Premiums-paid agree the tax deduction under section80C | Nominees get death benefits in the tax-free form under section10(10D) Premiums-paid agree the tax deduction under section80C |

| Opportunity of Investment | Investment funds can be shared out from a part of the premium | 100% Insurance Plan |

| Renewability | Optional-can be renewed once policy gets matured | Renewable- can be convertible into an endowment plan. |

Which one do you think is a better option?

Life insurance and term insurance plan both have their pros and cons. Life insurance can be prodigious for the first time to buy, so it is valuable to understand your requirements before buying any plans. Life insurance might be a great choice in the starting just because of its maturity return but might not be a perfect choice for everyone.

Term insurance makes sense to consider because of its reasonable price and offers enough life insurance coverage. Additionally, the amount that is saved on premiums by investing in a term insurance plan can be invested in other tax-saving investments.

In today’s perspective, experts recommend- if you want to go for life insurance then don’t mix it with your savings or investments, be clear to yourself that it covers life’s risks, life’ risks, for investments or savings there are various other options available in the market (SIP, Mutual Fund, bonds, FD, RD, etc.) or read about wealth management.

It is suggested to do thorough research before opting for any of the two plans. You will be provided different benefits along with the tax-savings benefits by different insurance companies under terms and conditions.

It’s seen that people buy the insurance and then after 2-5 years, they find the policy irrelevant or not fitting their needs and then they drop it, which makes a huge loss of policy premium paid because the insurance company will just refund a part of it.

Always research and compare the plans to find the right fit for you & then only choose it, because it’s the decision of your life & after!